It’s your job to find the right solution for your clients’ complex needs when it comes to employee benefits—but convincing them to try something new can be an uphill battle. After all, the world of traditional group health benefits hadn’t changed much since World War II, until the introduction of the Individual Coverage Health Reimbursement Arrangement (ICHRA) in 2020. ICHRAs have brought a new dimension of flexibility and freedom for businesses and their employees, but you’ve likely found that some companies are hesitant to make the switch to a system that’s unknown to them

However, when done correctly and effectively, an ICHRA can be a complete game-changer for the right clients. Making a compelling case for implementing an ICHRA requires careful planning and effective communication. It can prove to your clients that you’re ahead of the curve in providing valuable insights to change their employee benefits plans for the better. Here’s how to get started laying the groundwork for an ICHRA:

Step 1: Assess the company's current issues and challenges with traditional group insurance.

If your client is facing any or all of these three common pain points with traditional group insurance, you’ll want to demonstrate how switching to an ICHRA could help overcome those challenges

a. Lack of Customization and Benefits Quality:

Traditional group benefits are designed to provide standardized coverage for a large group, ultimately limiting individual choice, quality, and flexibility, and the lack of personalized underwriting could lead to healthier individuals paying higher premiums to offset coverage costs to high-risk members. Today’s workforce needs customized options to allow for geographically diverse and remote work, varying levels of coverage, and personal budget restraints. An ICHRA empowers employees to find benefits that work for their needs, from local in-network providers to a wider range of deductibles and more.

b. Cost Burden for Businesses/Employees:

We don’t have to tell you that rising premiums and limited flexibility in plan options can significantly burden businesses and their employees. "Health care renewal rates are skyrocketing, with companies seeing average increases this year of 6.5% on traditional group plans — and as high as 68% depending on the state and industry," says SureCo cofounder and CEO Matt Kim. To absorb the increasing costs, employers frequently need to reduced benefits or pass some of the expenses on to their employees, but an ICHRA can help company’s set their own budget and avoid unexpected increases, as well as save employees up to 12% on premiums.

c. Administrative Burden for Human Resources and Benefits Consultants

HR teams are not always fans of traditional group plans and their large-scale enrollment processes. It falls on the company to handle various administrative tasks, such as managing enrollment, premium payments, and handling claims for many employees, while dealing with multiple carriers, policy renewals, and compliance requirements. This burden can strain benefit professionals and divert valuable resources from other critical business functions. With the right administration partner, an ICHRA can reduce the time and resources needed to manage employee benefits.

Step 2: Understand the Individual Health Reimbursement Arrangement (ICHRA) and how it differs from traditional group plans.

ICHRA is a tax-free, account-based healthcare plan that enables employers to reimburse their employees for individual health insurance premiums and qualified medical expenses. ICHRA gives employees greater control in decision-making and more freedom and flexibility when choosing a plan that fits them best, and offers many solutions to the continuing challenges of the traditional group insurance model.

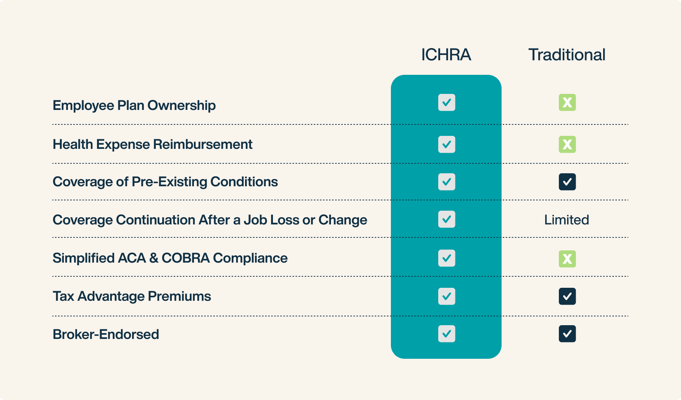

Here’s a quick look at the key differences between ICHRA and traditional group insurance:

For more information on ICHRA download SureCo's ICHRA Guide.

Step 3: Analyze Your Potential Cost Savings with an ICHRA Solution

One of the best ways to make the most informed decision on whether to recommend switching to an ICHRA is to look at how much money it could save a business. By using tools like the calculator provided by SureCo, a broker can accurately assess the fiscal impact of adopting the ICHRA solution. Understanding the cost differences between traditional group insurance and ICHRA enables businesses to identify potential savings, better allocate resources, all while providing personalized health plans that meet employer and employee needs.

Step 4: Back It Up with Case Studies & Facts

Finally, real-life examples of successful ICHRA implementations can help to paint the best and most accurate picture of its benefits and credibly demonstrate how it has positively impacted other businesses and employees. For starters, check out SureCo’s latest case study and see how KarmaCheck saved 54% on premiums by switching to an ICHRA.

Get a fully customizable audio guided slide deck—including benefits, stats, and savings. Use this handy tool to effectively present SureCo's ICHRA Solution. Download here and easily explain ICHRA to your team.

.png)

%20(2%20%C3%97%201%20in)%20(2).png)