Imagine you’re out to dinner. You’re on a budget and have been good about keeping it, plus you’re not that hungry, so you’re just going to order a salad and a side. Your friends are in the mood for steak. They order the aged prime rib with all the trimmings and yelp over a rare bottle of wine that they have to try.

Everyone eats. Everyone is happy. Stories are told, laughs are shared, and then the bill comes. Someone (not you) says, “Should we just split it evenly?”

Everyone nods. Your palms have started to sweat. You don’t have the budget to pay for someone else’s share of aged steak and merlot— you want to pay for your (delicious) salad and go home.

Welcome to traditional group healthcare coverage.

Right now, your company has people who only need a salad and are paying for other people’s steak and merlot. Or people who want to try the caviar but can’t. Just like splitting the bill evenly, group health insurance robs everyone at the table of their autonomy and ability to choose what’s best for them.

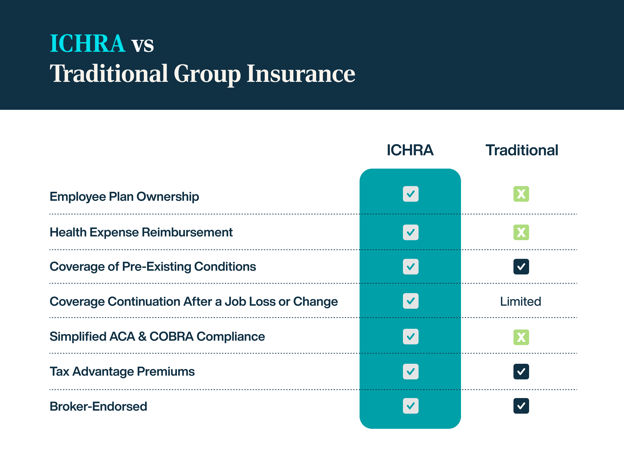

Enter, Individual Coverage Health Reimbursement Arrangements (ICHRAs).

What Is an ICHRA?

An Individual Coverage Health Reimbursement Arrangement (ICHRA) is an employer-provided health benefit model that allows employees to choose their individual health insurance coverage from all plans available in their area and get reimbursed from their employer tax-free for a portion of the premiums. If you haven’t heard of it, you’re not alone. ICHRAs are relatively new. They were introduced and made available to employers in 2020.

ICHRA plans make employees masters of their health insurance destiny during healthcare open enrollment. One employee wants steak? They’ve got it. Another wants sushi with a side of soup? No problem. Think of it like a 401(k) for health insurance — a defined contribution model that lets employees choose any plan from a range of competitive carriers with the click of a button.

The magic here lies in the free market competition. With employees free to select the best individual health plans that best suit their healthcare insurance needs, carriers are forced to compete for their business. The result? Lower annual healthcare premiums premiums and cost predictability. It's like opening the floodgates to a world of possibilities while keeping a tight rein on expenses.

Network Flexibility and Healthcare Plan Customization

ICHRA plans break the shackles of a restricted plan network and empower employees to customize their health insurance coverage. Whether someone wants the best individual health plan with their favorite doctors included or needs healthcare coverage that aligns with their budget and individual healthcare requirements, it's all available.

This newfound flexibility extends to network options, allowing employees to save money by choosing an individual plan with the right network for them. It's a win-win situation where employers and employees find common ground in pursuing tailored healthcare solutions.

Employee Empowerment at Its Finest

Picture a scenario where your employees are not just beneficiaries of health insurance but active participants in choosing and owning their policies. That's the beauty of an ICHRA — it puts employees in the driver’s seat, giving them greater control and empowerment over their healthcare decisions.

Say goodbye to the days of being stuck with a health insurance plan that doesn't align with individual needs. With ICHRA plans, employees become the architects of their health coverage, leading to a more engaged and satisfied workforce. For those reasons, your HR team will love ICHRAs.

Don’t Split the Bill

An ICHRA health insurance model promises a brighter, more flexible future for employers, employees, and insurance brokers alike. It's about choice, customization, and empowerment, all while keeping a close eye on the bottom line. Your workforce will thank you, and so will your bottom line.

Cheers to a healthier, happier, and more cost-effective employee health future—whether you’re toasting with sparkling water or wine!

Looking to move beyond traditional group healthcare coverage and take managing ICHRA plans to the next level? Learn more about SureCo’s enrollment software and how we serve as your ICHRA administrator to make your open enrollment this year that much better for your HR team and your employees.