42%

monthly plan savings

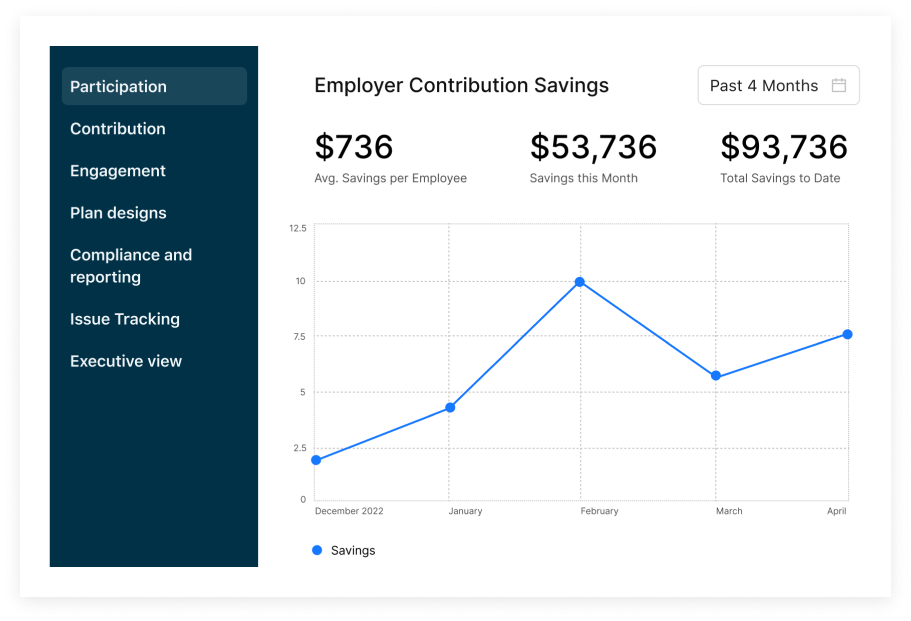

Ansafone, a leading provider of outsourced contact center solutions, with 800+ employees, brought its average monthly plan cost down from $971 to $562 by switching to an ICHRA with SureCo.

In addition to Ansafone's remarkable 42% reduction in plan premium costs, the company gave thousands of plan options to its employees and increased participation by 60%.

Try Now